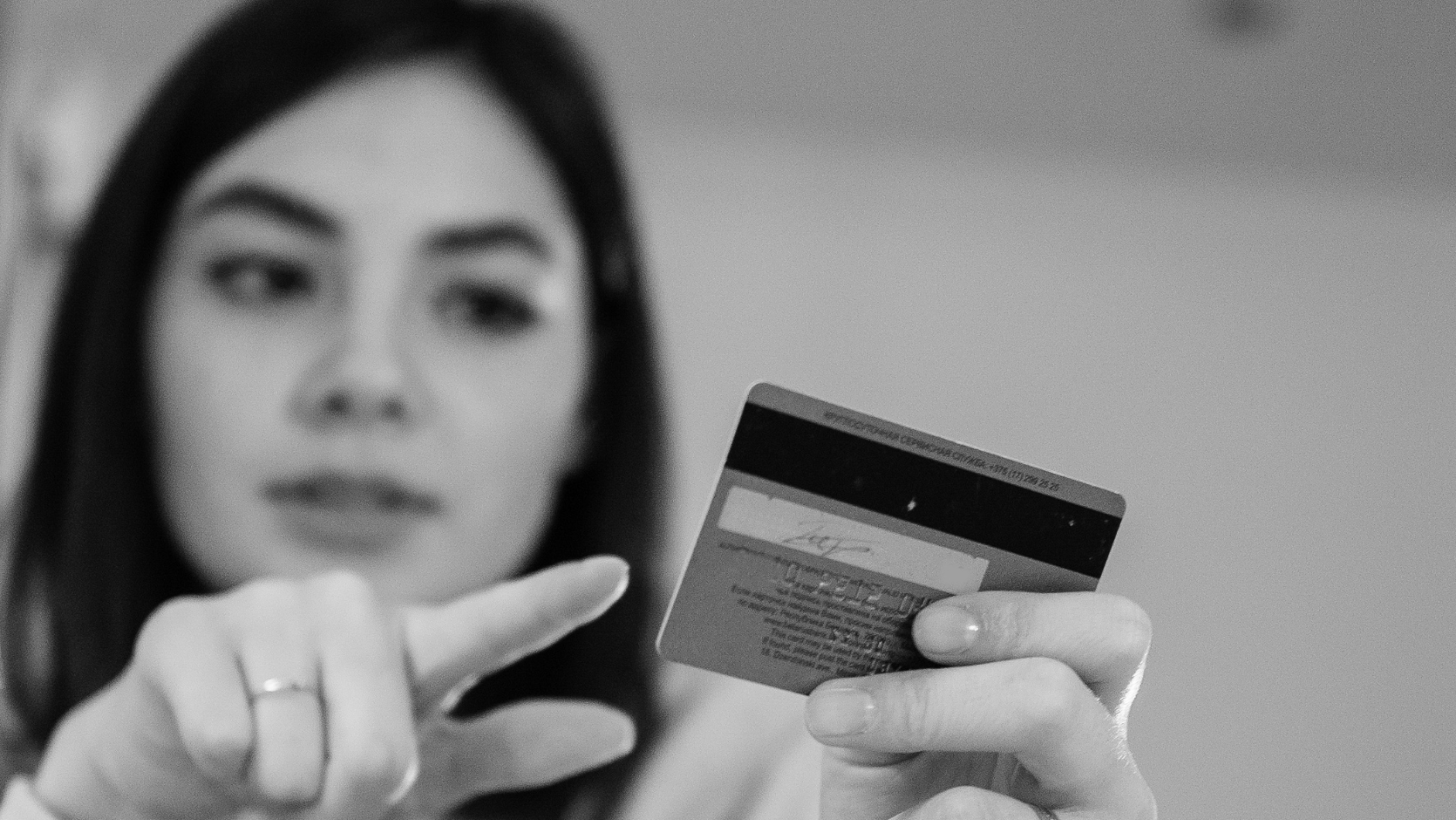

Many of us have had difficulty trying to cancel online subscriptions that just keep on being charged to our credit cards.

Difficulties faced by Australians trying to cancel online subscriptions

It’s often a website that offered a free trial and discounts when you joined up, but you don’t use it anymore. However, there it is every month on your credit card statement. It may only be a few dollars, nothing to get too worried about, but it certainly adds up over a year.

You try to cancel the payments, but it proves difficult, needing long-forgotten passwords, hard-to-find “unsubscribe” buttons or unresponsive “contact us” links. It is so frustrating that you give up, resigned to the dollars disappearing from your account every month.

You are not alone. Research by insurance group ING found Australians could save an average of $1,261 per year by cutting back on subscriptions and other regular outgoings they no longer use. (Please see Unused subscriptions and forgotten outgoings could cost each Aussie up to $1,261 a year.)

The Consumer Policy Research Centre found 76 per cent of Australians have had trouble cancelling an online subscription. It also found deceptive and manipulative online marketing tricked 83 per cent of Australians into sharing personal information and spending more than intended. (Please see Duped by design – Manipulative online design: Dark patterns in Australia.)

Calls for tighter laws to help consumers cancel online subscriptions

There are moves afoot to tighten the laws governing subscriptions, to make it easier for people to unsubscribe and to crack down on businesses that create subscription traps, making it difficult for consumers to stop paying for their services and end memberships.

Businesses that market their products online and require ongoing payments for membership or access should be aware of how these new laws could impact the way they do business.

Penalties under consumer laws can be severe, and businesses offering online subscriptions would be wise to seek legal advice to ensure they comply with any new laws.

ACCC pushes for consumer protections from subscription traps

The Australian Competition and Consumer Commission has called for tougher laws to protect consumers from unfair practices, such as subscription traps and confusing website designs. (Please see ACCC boss wants new powers to crack down on online businesses that make it hard to cancel subscriptions, The Guardian, 13 April 2023.)

ACCC Chair Gina Cass-Gottlieb called for a general prohibition on unfair subscription practices that would enable the watchdog to move quickly as technology and business practices change.

Strengthening penalties for breaching consumer law

Competition Minister Andrew Leigh says he is looking at other countries’ laws that penalise unfair online trading to help shape Australia’s laws, which are expected later in 2023.

Mr Leigh plans to increase corporate penalties for breaching consumer law from $10 million to $50 million, as well as introducing other tougher penalties.

The new laws could also include a requirement for a business to delete all personal information it holds on you as soon as you unsubscribe.

Everyone should regularly check their bank statements for every small charge that appears.

Of course, a guaranteed way to cancel a subscription is to cancel your credit card and get a new one. Inconvenient maybe, but you can wave goodbye to those unwanted subscriptions.